by Allison Summerton

Recently, we posted a blog about the importance of looking at the total cost of coverage – not just the premium – when selecting a health plan. As the deadline to enroll for coverage by Dec. 23rd for coverage that begins January 1st is fast approaching, today’s blog looks at another important factor when shopping for insurance – is your provider in the plan’s network? And what exactly is meant by network?

Health care providers include doctors, nurse practitioners, psychiatrists, psychologists, hospitals and clinics. Health insurance companies have contracts with providers to provide services to the people they insure. Insurance companies negotiate with providers on standards of care and the dollar amounts they will pay for health services. Together, this team of contracted providers is called the health plan network.

Although state and federal laws require insurers to maintain sufficient provider networks, the number and types of providers in the health plan networks are different for each insurance company and region. They even can be different for each plan from the same insurer, but they fall into three types of networks for plans offered in the Connect for Health Colorado marketplace:

• PPO: In a Preferred Provider Organization, the insurer contracts with physicians, hospitals and other medical providers to create a network of participating providers. You pay less out of pocket if you use providers that belong to the plan’s network. You can use doctors, hospitals, and providers outside of the network for an additional cost, usually in the form of higher coinsurance and maximum-out-of- pocket costs. The PPO may be a good plan for individuals and families who travel a lot or who have family members who live in other parts of the state.

• EPO: like the PPO, in an Exclusive Provider Organization, the insurer contracts with providers to create a network of participating providers. In an EPO plan, the insurer will only cover health care services provided by those within the plan’s network (except in an emergency). Your insurance will not cover the costs if you use a provider who is not in the network. When your provider refers you to a lab or facility for a procedure it is important to confirm that the lab is in network or you may have to pay the full price for the service. Generally, the EPO premiums are lower than the PPO premiums.

• HMO: The Health Maintenance Organization is both an insurer and a health care provider; it employs and contracts with providers to establish a health plan network. Generally, HMOs emphasize preventive care and most referrals are made to in-network providers. Like the EPO, HMOs will not cover out-of-network care except in an emergency. HMO premiums are less than the PPO premiums and within the same range as the EPO premiums.

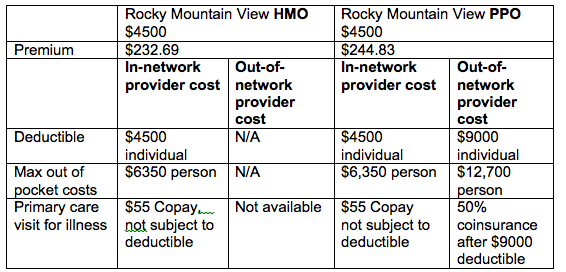

Usually, the premiums for PPOs are higher because they will cover a portion of services by providers outside the network. For example, Rocky Mountain HMO offers two health plans in the Colorado Springs area. For a 30 year old, the premium for the Rocky Mountain View HMO Bronze plan with a $4,500 deductible costs $232.69 a month. Under this HMO plan, a consumer would pay the first $4,500 for services provided by the in-network providers. If health care expenses are greater than $4,500, the consumer pays 40% of health care services provided by in-network providers until he or she reaches the out-of-pocket maximum of $6,350. After the maximum is reached the plan pays for 100% of the costs of in-network services. . The HMO will not pay for services provided by an out-of network provider.

The premium for a similar PPO bronze plan, costs $244.83 a month. The PPO plan has a $4,500 deductible for services provided by in-network doctors and a $9,000 deductible for services provided by out-of-network doctors. If the consumer receives services by an out-of network provider he or she would pay the first $9,000 for services provided by the out-of-network providers. If the out-of-network costs are greater than $9,000, the consumer pays 50% of the cost until he or she reaches the out-of-pocket maximum of $12,700. After the consumer has reached the maximum, the plan pays for 100% of the costs of out-of-network services.

Here is an example of the difference between the HMO and PPO plans from Rocky Mountain.

If you have a health care provider you know and like or if you have a health condition and would like to stay with a hospital you know, you can either select a plan with your provider or select a PPO which provides at least some coverage for out-of-network providers. In this case it would be less expensive to choose a plan that has the preferred doctor or specialist in the plan’s network.

The Connect for Health Colorado website provides a Search by Provider tool that enables you to search for plans that include your preferred doctors and hospitals in the network. Call your provider and the insurance company to confirm the providers are in the network before making a final selection.