Emma Sargent, Policy Fellow

One of the most popular features of the Affordable Care Act (ACA) is that health insurance carriers can’t deny coverage to people with preexisting conditions. However, this was not enough to ensure that people had access to coverage: insurance carriers could potentially cherry-pick consumers and only insure individuals who are healthier, and therefore less costly. They could do this by offering plans that are unattractive to people with chronic conditions, like plans with high deductibles, or by not covering everything that less healthy people need. This concern is called risk selection, because companies may select to insure only lower-risk, healthier individuals.

In order to counter the possibility of risk selection, the ACA included a risk adjustment program. The risk adjustment program redistributes money from insurance carriers who offer plans with lower-risk, or healthier, enrollees to those with higher-risk enrollees, thereby removing the financial incentive to only insure healthier people. Insurers with plans that enroll more than the average number of high-risk individuals receive compensation to even out the costs so that each individual insurance carrier does not undertake a disproportionate amount of financial risk for insuring high-risk individuals. When the risk of insuring less healthy individuals is spread across different carriers, individual companies are more likely to insure high-risk individuals, which makes access to health insurance more equitable. It also helps stabilize premiums and improve value for everyone insured because there is less uncertainty about enrollee cost; it ensures that high-risk individuals pay similar premiums as healthier individuals, which helps create a more equitable health insurance landscape.

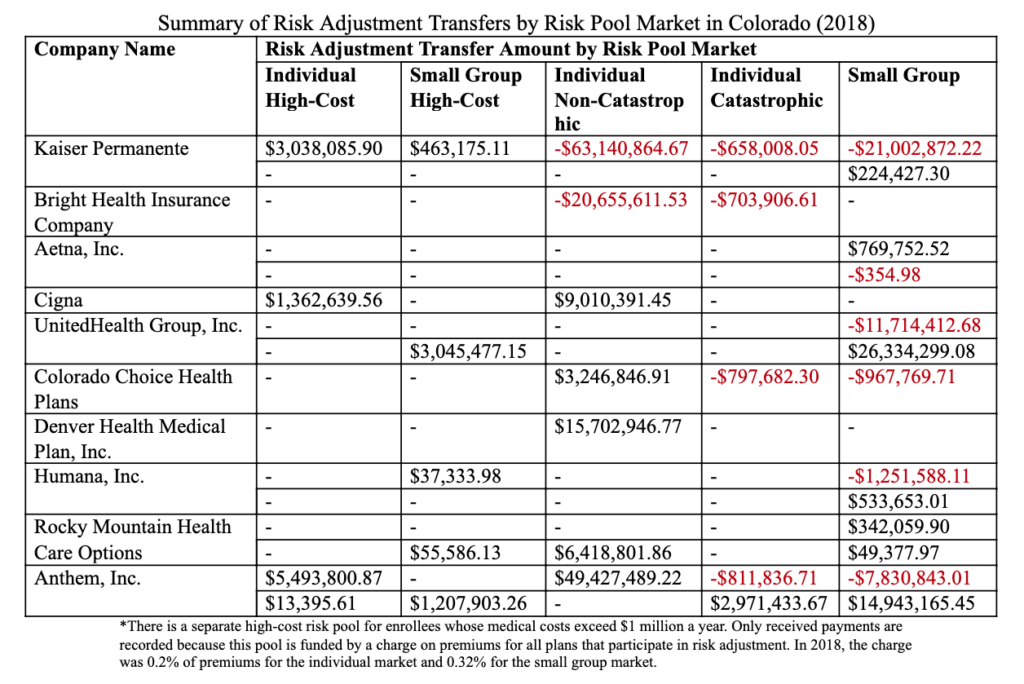

So what does the risk adjustment program look like in practice? All carriers that offer non-grandfathered plans, or plans created since the passage of the ACA in 2010, in either the individual or small group markets participate in the risk adjustment program. Individuals receive a risk score from the Center for Medicare & Medicaid Service (CMS), which is determined based on their age, sex, previous diagnoses and other measures that correlate with their likelihood of needing health care. For example, older people may have a higher score, as may people with a chronic condition. CMS uses a risk adjustment model that groups diagnoses with similar predicted health care costs and assigns a risk score for each tier. Based on the aggregate of individuals’ risk scores, each insurance plan is given a determination of its average actuarial risk. Because some insurers offer plans in the small group marketplace that are high-risk while offering plans in the individual market that are low-risk, for example, adjustments are based on plan rather than carrier. At the end of the year, plans with higher actuarial risk will receive financial compensation, while plans that enrolled fewer high-risk individuals and had lower actuarial risk will make payments to the high-risk plans.

Earlier this summer, the Centers for Medicare and Medicaid Services (CMS) released its risk adjustment report for 2018, which details how much money moved between insurance carriers as a result of the risk adjustment program. In total across the US, $10.4 billion was transferred – $5.2 billion in payments showing as a cost to insurance carriers, and $5.2 billion in charges showing as revenue for carriers. The report showed that plans that received risk adjustment payments were likely to have paid more claims, which suggests that the program is working as intended and distributing the financial cost of insuring high-risk individuals evenly throughout the insurance landscape.

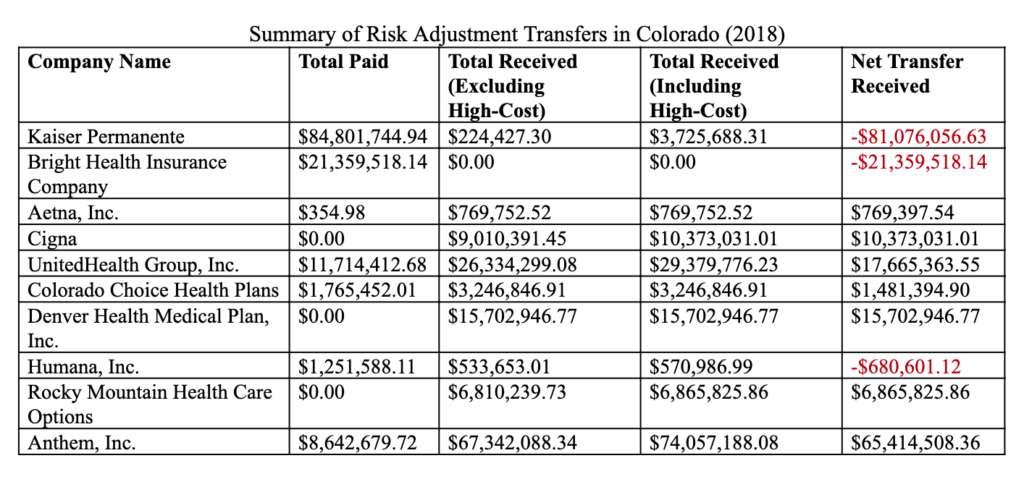

In Colorado, around $260 million was transferred between plans. Seven insurers received a net transfer, while three paid a net transfer. The tables below detail how the money transferred between plans, including which insurers participated and for which markets. Overall, Kaiser paid the most money, indicating that their pool of enrollees has lower-than-average risk, and Anthem received the most money.

For Colorado consumers, these risk adjustment transfers indicate a diffusion of financial risk in the health insurance marketplace, which means more stability in their premiums, lower premiums for high-risk individuals, and more equitable access to health insurance as high-risk individuals are able to find health plans that cover their needs. When insurance carriers are incentivized to insure all individuals, health plans become more accessible and affordable overall.

However, there is current litigation challenging the risk adjustment program. On September 25, the Tenth Circuit began hearing oral arguments for an appealed challenge to CMS’s risk adjustment methodology. In the original lawsuit, New Mexico Health Connections (NMHC), an insurance company, claimed that the ACA does not require CMS’s risk adjustment methodology to be budget neutral, so the statewide average premium that partially funds the program cannot stand. While the federal legislation does not prohibit or require budget neutrality, CMS’s regulations did not explicitly justify it – which a New Mexico district court determined is grounds to invalidate the premium. As a result of the ruling, $10.4 billion of risk adjustment payments was temporarily frozen. Now, the Tenth Circuit is hearing this case; it could either uphold CMS’s methodology and the risk adjustment payments based on it, or uphold the district court’s decision. If that is the case, the implications are unclear: CMS could potentially just issue a retroactive methodology justifying budget neutrality to apply to those years. However, as yet another lawsuit against an aspect of the ACA, this case demonstrates the building legal challenges facing the crucial law. Risk adjustment is one of the many ways that the ACA both stabilizes the market and ensures that consumers have access to affordable and equitable health coverage; it is essential that it, and the entire ACA, withstands these challenges to continue benefitting people across Colorado and the U.S.