by Matthew Valeta, Health Policy Analyst

Proposed 2015 health insurance rates are in and there is plenty of good news for Colorado’s consumers. Most insurers in Colorado’s individual market are proposing single digit increase and some consumers will even see their rates go down.

Over 130,000 Coloradans already enrolled in the marketplace will continue to have the opportunity to get health insurance tax credits, which will reduce the price of their premiums. Coloradans receiving tax credits qualified on average for $248 per month off the sticker price of their insurance.

In the past in Colorado, rates in the individual market have increased at an average of anywhere from 5.9% to 9.9%. Many factors go into designing the health insurance including costs of health care services and pharmaceuticals as well the administrative expenses and profits/surpluses kept by insurance companies. These low rate increases and rate decreases for insurance plans that started in 2014 are a sign that Obamacare is starting to rein in the skyrocketing costs of health insurance.

These rates are not yet the rates that Coloradans will be comparing when shopping for a plan this fall. Proposed plans now go through the rate review process where the Division of Insurance (DOI) reviews them to make sure they are justified. If there is not sufficient justification for a proposed rate change, the Division and can cut the rate even further. The rate review process has saved Colorado’s consumers over $100 million on their premiums since 2006.

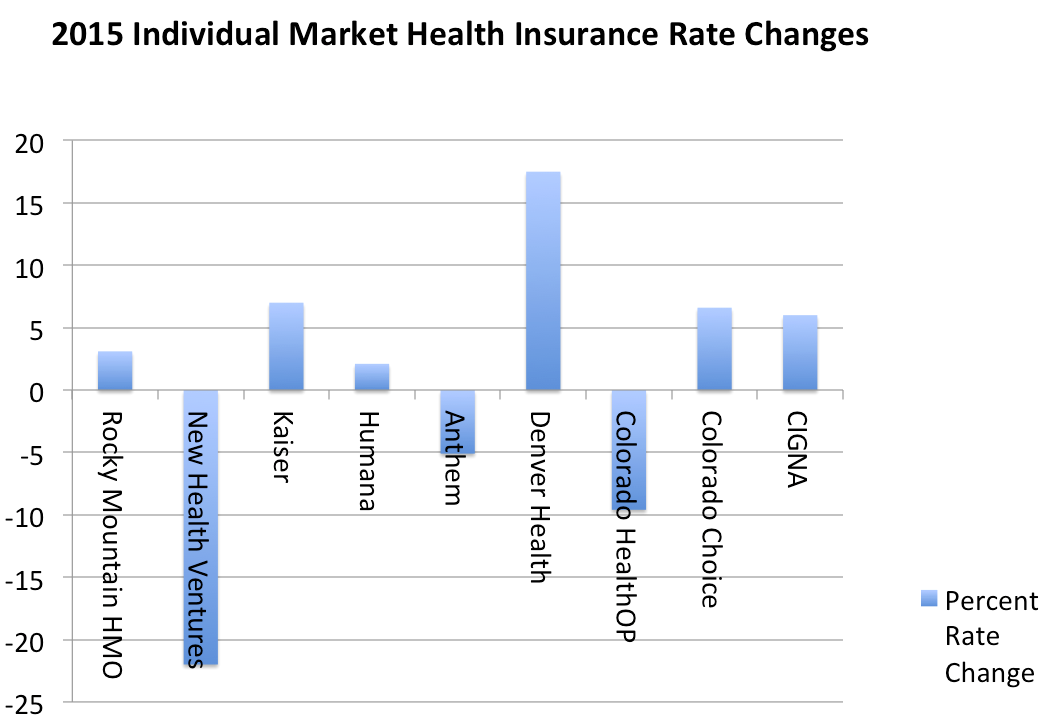

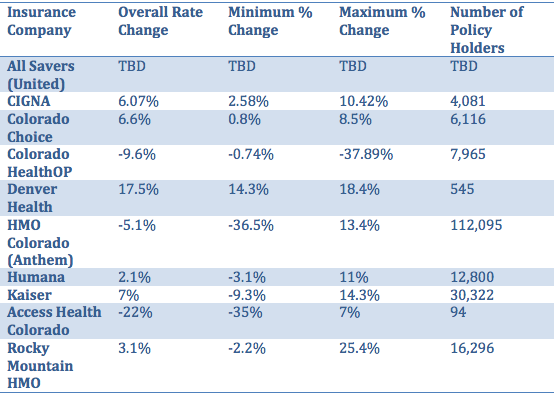

Here are details of the proposed changes to rates in the individual market:

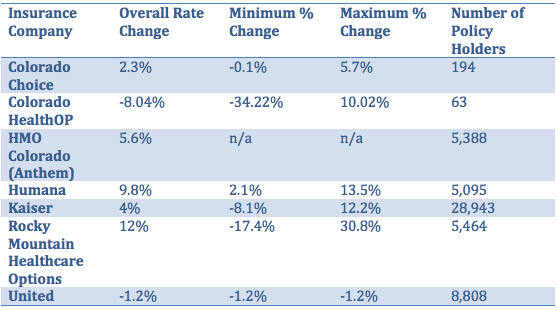

We also pulled out some of the proposed rates in the small group market.

- Specific plans with the filings may have different proposed premium changes than the overall rate change.

- These filings include proposed changes to rates that are sold both on and outside Connect for Health Colorado

While this is good news, the rates could be even lower. CCHI wants to help make your voice heard. The Division of Insurance considers consumer comments when making sure that proposed rate increases are justified. We’re urging the Division to take a hard look at the proposed rates to make sure they are appropriate. You can tell the DOI about how rates would impact you by emailing the Division of Insurance at susan.buth@state.co.us

You can search the rate filings yourself here.

If you would like help from CCHI learning more about your rates or submitting comments, tell us your story here or email us at mvaleta@cohealthinitiative.org.