by Matt Valeta, Health Policy Analyst

The myth of rate shock continues to be just that…a myth.

On Friday, the Division of Insurance released the final rates for health insurance plans in 2014, and Coloradans will have a robust marketplace with strong competition that should combat increases in premiums going forward. Some had raised fears of increased rates, or “rate shock” in 2014, but we’re just not seeing that here in Colorado. While these are new plans with new coverages, these finalized rates confirm that Colorado consumers will have more access to affordable coverage—and financial assistance will help Coloradans get covered and see their doctor without unpredictable costs.

The new rates vary quite a bit based on a person’s age and geographic location, but all Coloradans will be able to choose from at least several insurance carriers and different levels of coverage. For example, in Fort Collins rates for silver level plans for 40-year-olds ranges from $232.91 to $500.62 dollars a month.

There are more affordable options too. Bronze level plans offer cheaper premiums in exchange for slightly less robust coverage and start at just $176.89 a month in Fort Collins. Plus, Coloradans purchasing these plans still qualify for financial assistance.

Coloradans under 30 have the option to purchase catastrophic plans to protect them from enormous medical bills. These plans are available starting at $135.57 for a 27-year-old.

Before Obamacare, going the bare-bones routes on health insurance could still leave you very exposed to astronomical medical bills. Health insurance isn’t very helpful if you still go bankrupt is it? With new plans with better coverage, all Coloradans have access to better plans at a more affordable cost.

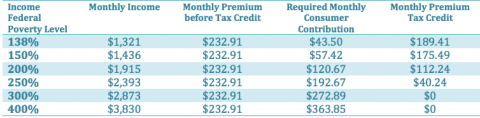

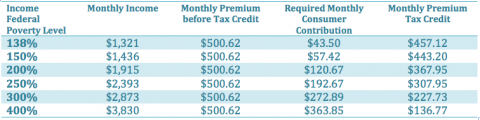

But these are not the rates that the majority of Coloradans will pay. Many consumers who purchase plans in Connect for Health Colorado will be eligible for upfront financial assistance to help purchase health insurance. Here is a breakdown of how the subsidies might work.

Projected tax credits for lowest cost silver level plan for a 40-year-old in Ft. Collins:

Projected tax credits for highest cost silver level plan for a 40-year-old in Ft. Collins:

The plans sold in Connect for Health Colorado, Colorado’ new marketplace, will provide better coverage to Colorado consumers and small businesses than plans that are available today. And, with financial assistance available to help make plans more affordable, consumer will be able to find plans that best fit their needs instead of only worrying about costs.

Safe to say that the myth of rate shock is:

You can see the complete summaries from Colorado’s Division of Insurance for yourself here:

- Individual Premiums from all Carriers

- Small Group Premiums from all Carriers

- Number of Carriers and Plans for 2014

- Summary of Premiums for 2014

- Map of Health Insurance Rating Areas for Colorado