On Tuesday April 9th, the House Health, Insurance & Environment will consider HB13-1290 ‘Modernize Stop-loss Health Insurance.’

HB13-1290 will ensure a more sustainable small group health insurance marketplace in Colorado by protecting the integrity and sustainability of the small group market. HB13-1290 raises Colorado’s individual attachment point for stop-loss insurance policies to $30,000. Colorado’s Insurance Commissioner is given the rule making authority to raise the attachment point based on the consumer price index and to collect more information about Colorado’s stop-loss market. Finally, this bill requires stop-loss issuers to offer plans that do not discriminate or medically underwrite against individual employees. This is known as lasering.

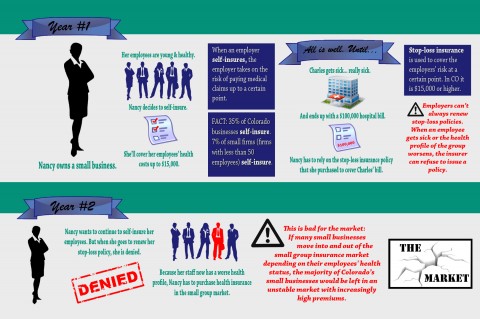

The current stop-loss law threatens to destabilize the small group market and the Small Employer Health Options Program (SHOP) in Colorado’s health benefit exchange Connect for Health Colorado. Currently, the minimum individual attachment point for stop-loss policies is $15,000 per person. Stop-loss plans are not “guaranteed renewable.” A stop-loss issuer could deny the renewal of stop-loss policies if an employer’s group had a high amount of health claims. This is known as adverse selection. These small employers would only be able to find insurance coverage in the small group market and the SHOP exchange. If small businesses only purchase insurance in the small group market when their employees are sick, premiums would go up for everyone. HB13-1290 protects the progress Colorado has made creating a new health care market by ensuring that small group market and the SHOP are not subject to increased premiums because of inappropriate use of stop-loss.

Rising healthcare costs continue to be one of the biggest issues facing small employers. HB13-1290 protects the integrity and sustainability of the small group market, in which the vast majority of small employers purchase their healthcare coverage. Modernizing Colorado’s Stop-loss law will ensure that the small group market is a valuable resource for insuring Colorado’s employees.

Learn more about stop-loss insurance: