by Matthew Valeta, Health Policy Analyst

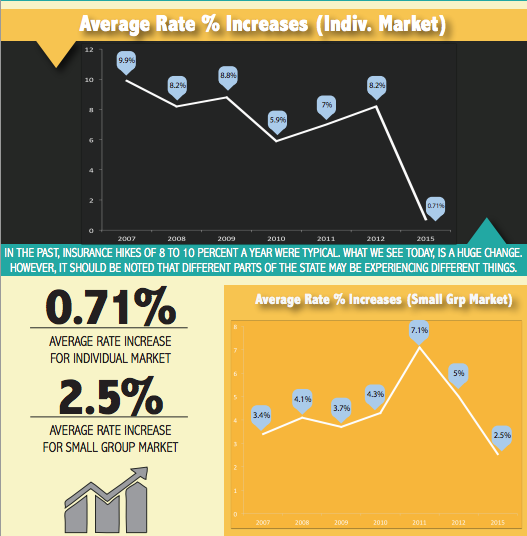

The Affordable Care Act is working as intended. Before the ACA, rates were increasing at an average of 8% in the individual market and 4.6% in the small group market from 2007 to 2012. For next year we know that individual plans are on average only increasing 0.71% and small group plans are going up by 2.54%. Overall, this is only a 1.18% increase in rates from 2014 to 2015.

Coloradans should be celebrating our incredibly competitive marketplace, Connect for Health Colorado. Besides being far below the historical average rate of premium growth in Colorado, the growth in Colorado’s premiums is also below the average rate increase from other states that set up state-based marketplaces including California (4.2%) and New York (5.7%).

Why are these rates lower?

First, Connect for Health Colorado is one of the most competitive marketplaces in the nation with 10 insurance companies selling plans in the individual market. In order to attract your business, they have to be able to compete on price.

Second, carriers have been working with health care providers to develop more affordable health insurance options. These efforts especially paid of in Colorado’s mountain communities this year.

Finally, insurance companies are also offering affordable prices through ‘narrow network’ or ‘value’ plans. If you can navigate a plan that has a smaller network these plans are one way to save money on your premiums.

Shop until you drop

All this good news means you had better shop to make sure you are getting a good deal. The numbers above are averages and you want to make sure that your plan fits your health and financial needs. Whether or not your premiums are going to change next year depends on the specific plan you enrolled in.

Here are some tips from the Division of Insurance about shopping for a new health insurance plan.

- Is your doctor or hospital of choice included in the plan’s provider network? Seeing an out-of-network doctor typically is more expensive.

- Lower premiums often mean higher costs when receiving care. Find out if there is a deductible and how much it is, as well as the out-of-pocket maximum. Determine what you would have to pay for a doctor’s visit.

- Find out about prescription coverage, especially if you need specific medications.

- Does the plan cover procedures you may need some day, such as back surgery, ambulance service, MRI scans or knee replacement?

- Consumers who have questions about their current plans should contact their insurance carrier, Connect for Health Colorado, their insurance broker, or their employer.

Financial Assistance is Changing

Another big reason you’re going to want to shop– financial assistance (the advanced premium tax credits) is changing. Because financial assistance is based on the cost of the second lowest silver plan in a region, when the price of that plan goes down the tax credit goes down. In real dollars, someone earning about $17,000 a year will see their premiums maximum financial assistance change from $342.55 a month to $241.65 a month in 2015. If you received financial assistance in 2014, you NEED to double check and make sure that your plan will still be affordable if the amount of financial assistance you are eligible for changed.

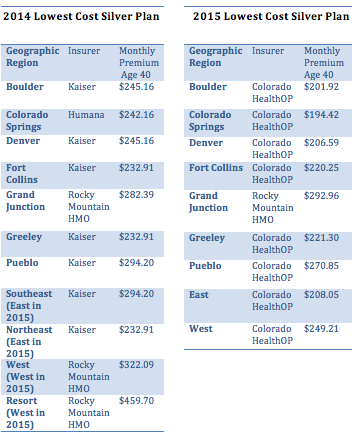

So, here’s a quick primer on what the lowest silver plan looked liked in 2015 and 2014 (before financial assistance). The marketplace opens November 15th. Make sure you’re ready to get a great deal!

Make sure you check out all the resources put out by the Division of Insurance: