by Matthew Valeta, Health Policy Analyst

Colorado health insurance companies have proposed their rate for the next year. We have been examining the rates to ensure that no unjustified costs are being put into consumers’ premiums. As part of the rate review process in Colorado, the Division of Insurance reviews health insurance rate increases in the individual and small group market to ensure that they are not excessive.

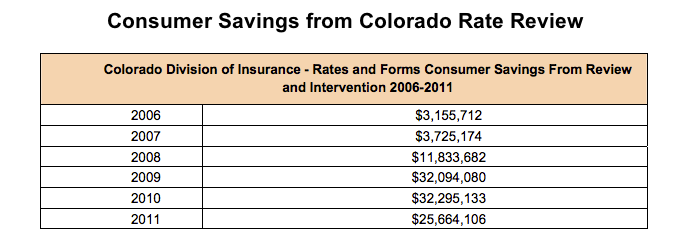

Since 2008, rate review has saved Coloradans over $100 million dollars on their premiums.

Thank you to the hundreds of you that signed the Colorado Public Interest Research Group’s petition urging the Division of Insurance to make sure that every penny of these rate increases is justified. We met with the Commissioner this week to deliver your petition, to share your comments, and to talk about why it is so important to have public input in the rate review process.

Thank you Commissioner Salazar for taking the time to hear consumers concerns.

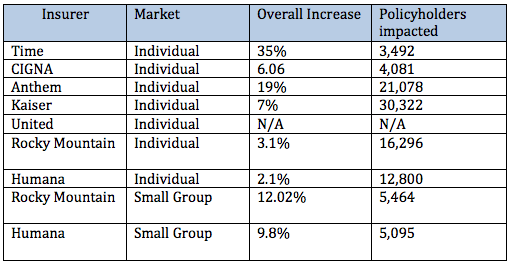

After digging into the comments, we have submitted specific comments to the Division of Insurance on the following plans (links to full comments below):

Here are some of the major themes we saw when digging into the rate proposals.

Too Many Secrets

Insurance companies have requested a long list of items to be confidential in these filings. Some factors that have been marked as confidential include:

- Projections of the health of their enrollees

- Geographic experience

- Reinsurance development assumptions

- Membership distribution

- Rate development methodology

This lack of transparency and consistency in insurers’ rate filings impedes the ability of Colorado policymakers and outside stakeholders to evaluate how proposed rates were developed. This is especially true when the rate development methodology itself is marked as confidential! Greater transparency in the rate review process will help ensure that rate increases are justified and help drive competition in the health insurance market. We have urged the Commissioner Salazar to use her authority to make more of Colorado’s rate filings public.

Failure to Account for the Reduction in Uncompensated Care

According to CCHI’s analysis, insurance companies did not adjust their cost projections to reflect a reduction in uncompensated care and charity care that is already occurring in Colorado due to the expansion of health insurance under the Affordable Care Act.

Earlier this summer, the Colorado Hospital Association released a report stating that the decrease in the average charity care per hospital for Colorado was -36.2%. Already in the first quarter of 2014, Colorado hospitals have seen more Medicaid patients and the proportion of self-pay and charity care has declined.

This reduction in uncompensated care will lead to significant saving for hospitals and fewer costs will need to be shifted onto insured consumers. While insurance companies will be able to use this information when negotiating with hospitals, they have not indicated how these savings will be reflected in premiums. Without addressing the impact of the expansion of care to over 300,000 Coloradans, insured consumers could be paying extra premiums for cost shifting that has been significantly reduced.

The Health of New Enrollees

Several insurance companies have projected that they expect new enrollees in 2015 to have higher health risks than consumers in 2014. However, there are several factors that are likely to bring healthier, not sicker, consumers into insurance in 2015.

- Consumers with the highest health needs are likely to have already obtained insurance and received treatment.

- Pent-up demand on the health care system in 2014 by newly insured consumers will have been satisfied.

- More consumers will be moving from the pre-ACA individual market to new plans as they become aware of the availability of advanced premium tax credits.

Overestimating Pharmaceutical Costs

Several insurance companies filed extremely high projections for the cost of pharmaceuticals, sometimes just for one drug. Humana proposed a 19.1% increase in their projected pharmaceutical costs almost entirely based off of one new drug that treats Hepatitis C. However, this proposed double-digit increase in pharmaceutical costs in 2015 is far higher than the growth rate of 3.6% from May 2013 to May 2014.

We have asked Division of Insurance to give these double-digit pharmaceutical increases careful scrutiny since they are so much higher than national trends.

We have also asked the Division of Insurance to take a closer look at whether these companies have a disproportionate number of enrollees with Hepatitis C. If insurance companies are able to use these drugs to treat hepatitis C there is potential for savings from avoiding future hospitalization costs.

Stay tuned to CCHI and @coratewatch for more information about the proposed 2015 health insurance rates. The Colorado Division of Insurance will continue to examine these insurance rates through the rest of the summer until they are finalized sometime in September. It is important that the Colorado Division of Insurance verify that no insurance company is taking advantage of consumers in this mass filing process. Affordable health insurance premiums are critical to ensuring that consumers have access to the care they need when they need.

Links to full comments as submitted on each rate filing:

Comments on Time Insurance Company-ASPC-129568044

Comments on Cigna-CCGH-129556862

Comments on Kaiser-KFHP-129483478

Comments on United Healthcare/All Savers Insurance-UHLC-129554702

Comments on Rocky Mountain Healthcare Options-LEIF-129536172

Comments on Pharmaceutical Trend (Anthem/HMO Colorado-129533156, Humana-129570268, Rocky Mountain HMO-129536169)