by Matt Valeta, Health Policy Fellow

Moving from college to the ‘real’ world has required some personal adjustments. Turns out becoming a grown-up requires a whole new set of responsibilities like bills, not taking naps everyday, and eating something besides fruit loops for dinner. However one responsibility that I am lucky to have some help with is in my post-college experience is health insurance. Unlike many of my graduated peers, I am lucky enough to have coverage through my employer.

Since coming to CCHI, I have learned just how valuable it is to have an employer help provide me health insurance. Since 1996, employers sponsored health insurance rates have increased 85%. From 2006, individuals purchasing insurance on their own have seen their insurance premiums go up at least 11.6% every year.

One of the most exciting parts of my new job at CCHI is working to give consumers relief from the consistent rise in insurance premiums. CCHI recently hosted an event on rate review with Joe Ditré from Consumers for Affordable Health Care in Maine. Rate review is a process that requires state insurance departments to review requests for health insurance rate increases before implementation. Under Obamacare, health insurance companies are required to submit any increases in rates over 10% to the federal rate review program. In Colorado, thanks to a CCHI backed law that passed in 2008, the Division of Insurance (DOI) must approve ALL increases in health insurance rates.

At our recent training, Joe highlighted several signs that an insurance company requested rate increase is unreasonable.

- If an insurance rate has raised rates more than once a year this creates a compounded and unreasonable financial impact on consumers.

- Companies reporting large profits, surpluses, and/or dividends to stockholders could be increasing their rates without need. Humana paid over $30 million in dividends in 2010 alone.

- Obamacare’s Medical Loss Ratio requirement, or the 80/20 rule, requires insurers to spend at least 80% of their premiums on health care benefits to consumers. If an insurer is spending significantly below the 80% level they are already collecting too much in premiums.

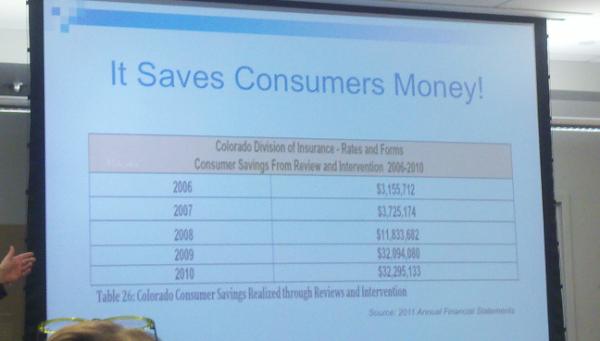

Rate review is already beginning to work as in 2010 it saved Colorado consumers $32.2 million in unnecessary rate increases!

For me it is exciting to work on rate review because this is where the money is. Over $7 billion is collected in health insurance premiums in Colorado every year. Hopefully I can help provide some financial relief to consumers like my parents who always had insurance for me when I broke my arm or had appendicitis.

Coloradans should be able to get the care they need to stay healthy and see a doctor when you need to without enormous costs from repeated insurance rate hikes. You can help CCHI make rate review even more effective by filing comments about how rate increases have impacted you at the Division of Insurance’s website. Your access to affordable quality health insurance is too important to be left to the insurance companies.