by Allison Summerton

If you are shopping for insurance for yourself and/or your family there are a lot of resources to help you. The new insurance marketplace, Connect for Health Colorado, has trained and supported a network of brokers and health coverage guides you can meet in person to shop for and purchase the best health insurance plan for you and your family. You can search for a health coverage guide or broker by zip code on the Connect for Health website.

If you would like to learn a little about health insurance before you select a plan, we will be posting a series of blogs over the next few weeks on health insurance basics and some of the important things you may want to consider when you are shopping.

The number one concern for most people is the cost of health insurance. The most obvious is the health insurance premium, but that’s just one factor to consider when you are trying to select an affordable health plan. There are five things to consider that may add to your overall cost of health care in a year.

• Premiums- the amount that you pay monthly to buy health insurance

• Deductible – the amount that you will need to pay before your plan begins paying for services. The deductible is specific to each health insurance plan.

• Copayment–a dollar amount you pay each time you visit a doctor or pick up a prescription. Some plans require a higher copayment for a visit with a specialist.

• Coinsurance – Instead of a copayment, some plans may require you to pay a percentage of the services you receive. For example, if you need an x-ray you might be required to pay 20% of the cost.

• Annual maximum out of pocket costs is the cap on the amount you need to pay in deductibles, copayments, and coinsurance each year. The maximum varies by health plan but the maximum set by law is $6,350 for an individual and $12,700 for a family for 2014.

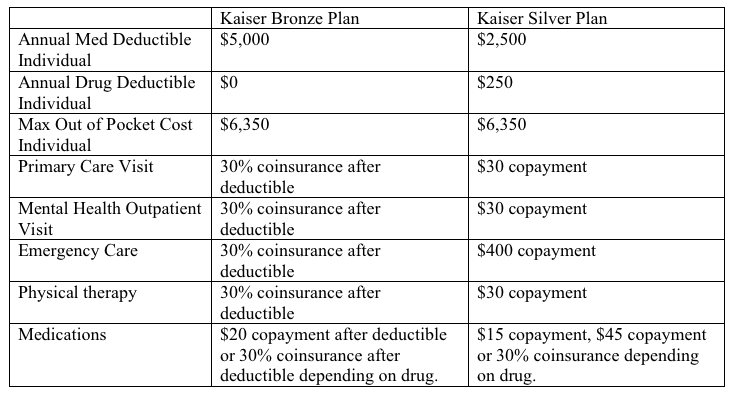

Here is an example of how the deductibles and copayments affect the overall cost of care in one year under two plans offered on Connect for Health Colorado.

How does this work?

If we use the health plans above for two different people, we will see two different costs, depending on their ages and circumstances.

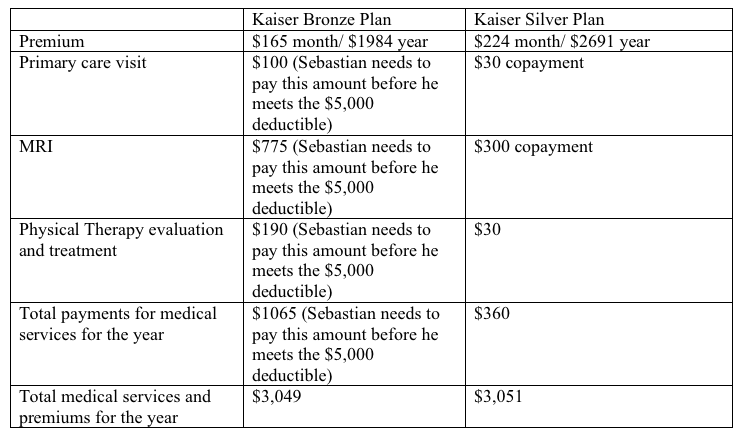

Sebastian

Sebastian is a healthy 30 year-old living in the Denver area. He has no regular drug costs. However, like many active Colorado people, Sebastian injured his knee, goes to his primary care doctor and needs to have an MRI to see if he has torn a ligament. Thankfully he does not need surgery but requires some physical therapy. The potential cost of his services for the year would be:

Generally, Bronze plans have lower premiums and higher deductibles. This Bronze plan has a deductible of $5,000 so Sebastian will pay the $1065 in payments for medical services because coverage does not begin until after he pays the first $5000 in non-preventive care services. Although the Silver plan has a $2,500 deductible, the plan does not require him to pay the deductible for the primary care and therapy services. Instead he pays copayments which are lower and more predictable than the coinsurance amount. For Sebastian, the total medical services and premium costs are very similar for the Bronze and Silver plans.

Under Obamacare, Sebastian will not have to pay for preventive care, like a checkup or a flu shot, under either plan. So his selection of a plan may really depend on how healthy and active and injury prone he is likely to be.

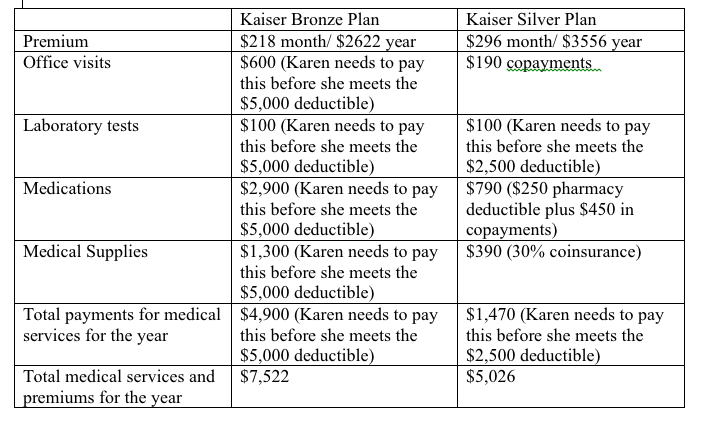

Karen

Karen is a little older and a little less active. She has type 2 diabetes, so she sees her health care provider and a specialist several times a year and takes regular medications. The potential cost of her services for the year would be:

With the Bronze plan, because she has a condition that requires more ongoing care, Karen will need to pay more money up front. Karen will need to pay the first $5,000 for medical services. If her health care expenses are greater than $5,000, Karen will pay 30% of the medical care until she reaches the out-of-pocket maximum of $6,350. The Bronze plan will cover all of her medical expenses above $6,350 in 2014.

Under the Silver plan the copayments for the office visits and the medications help to reduce Karen’s health expenses. The plan uses both copayments and coinsurance, (the plan requires 30% coinsurance for laboratory tests and medical supplies) so it is important to find out the cost sharing arrangements for each plan.

Things to consider:

• Generally, plans with low monthly premium have higher deductibles and coinsurance

• Plans may have separate deductibles for medical services and medications

• Some services may be provided without meeting the deductible, like primary care services

• Copayments may be more predictable than coinsurance payments

• Plans may have higher copayments and coinsurance payments for providers out side of the plan provider network (to be discussed in a future blog).

How do you find the plan details?

Information on the premiums, deductibles, copayments, coinsurance and out of pocket limits is available on the Connect for Health Colorado website. Click on the name of the health plan and a screen will display details on the plan deductibles, copayments and coinsurance. Or, if you would like to compare the details of 2 or 3 plans at once, select the plans you would like to compare and then click on compare plans.